(888) 895-1776

(888) 895-1776

Alex Stone

Alex Stone  Oct 9, 2022

Oct 9, 2022  0 Comment

0 Comment HOW DO INFLATION AND RISING INTEREST RATES EFFECT THE VALUE OF RENEWABLE ENERGY LEASES?

Inflation is on everyone’s mind right now. We worry about the impact of inflation on the cost of what we buy, the value of our assets, our ability to purchase a home, etc. If you have a solar or wind lease, you may be wondering how inflation and rising interest rates effect your lease’s value.

I’m spending more of my time than ever with our lenders and investors navigating the current economic environment. The intent of this post is to share some of the themes going on in the capital markets and how they impact properties being leased to solar and wind projects.

Interest rates probably have the single biggest impact on the value of a ground lease. Lease values move inversely to interest rates. As interest rates decrease, the value of a ground lease increases. The opposite occurs when interest rates go up.

There are direct and indirect reasons for this. An indirect reason is rising interest rates make alternative investments more attractive. People need to find places to invest and grow their money. This is very difficult to do when savings accounts are paying 0% in interest. It forces people to be more aggressive in seeking investments. As rates have risen, there are many ways to earn 3-4% on your money with relatively little risk. Examples include CDs and government bonds. It’s less attractive to make investments, like buying properties at 4-5% returns, when you can earn almost as much with no risk and very little effort in a CD.

Another way that investors think about what the appropriate return on an investment should be is by applying a “spread” to a “risk-free” investment. A Treasury bill is an example of a risk-free investment. Treasurys are considered risk-free because repayment is guaranteed by the US government. In January 2022, the 10-year Treasury was yielding about 1.70%. At the date of this article, just 10 months later, that same Treasury pays almost 3.90% – an increase of 229%.

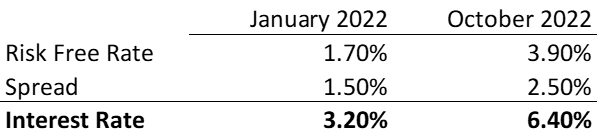

Because other investments have more risk than a bond backed by the US government, investors demand a premium for this risk. This premium is called the spread. This spread varies greatly depending on the investment. However, spreads are not static. As the risk of more inflation and a recession weigh on investors, they require a higher spread, or premium, for taking risk. A spread that may have been 1.50% in January, could now easily be 2.50%. The table below illustrates these impacts on interest rates:

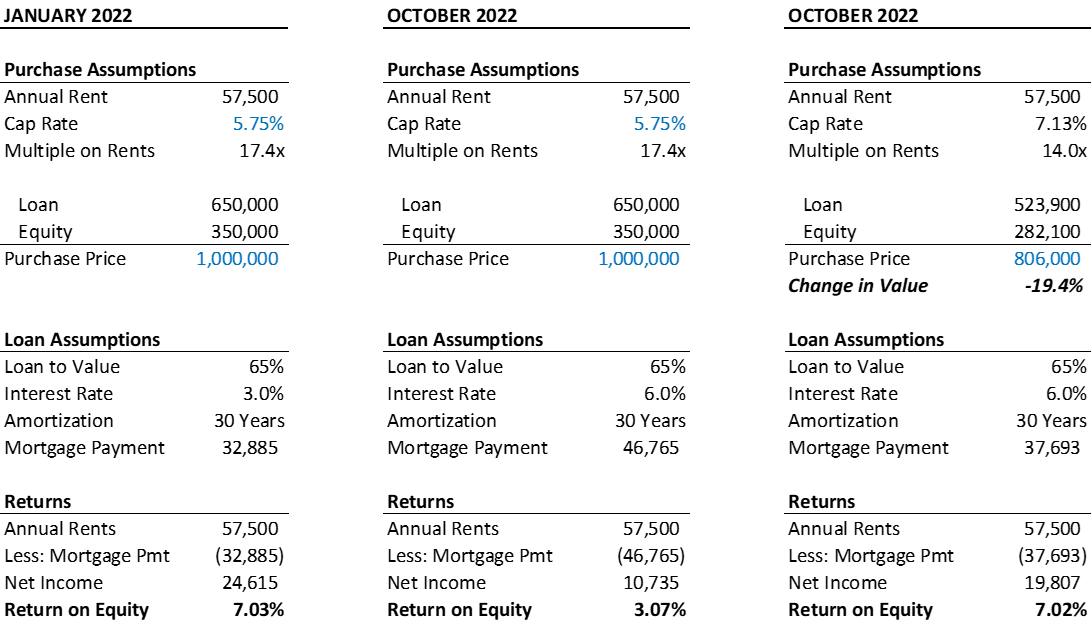

To understand the direct impact of higher interest rates on a ground lease (or any similar investment), let’s look at the table below. The first column shows the economics of a ground lease purchased in January 2022. An investor could pay 17.4 times the current rent and expect to receive a return on their equity investment of approximately 7%. This was very attractive return when compared to alternative investment options.

As interest rates have increased throughout the year, an investor would now receive approximately a 3% return on that same investment (the middle scenario). The reason for this is that approximately $14,000 per year that would have gone to the investor is now going to the bank in additional interest payments on their loan. A 3% return is not attractive because an investor can get that same return in a CD, or similar, risk-free investment.

The equivalent pricing in order to receive a 7% return in today’s higher interest rate environment is on the far right column. An investor could pay 14 times the current rent, or nearly 20% less, to receive the same return. The good news for owners of ground lease assets is that, at this point, investors are accepting lower returns and actual market pricing is somewhere between 14-17 times current rent.

Where Do We Go From Here?

The Fed has indicated that more needs to be done to rein in inflation and that they will continue to raise rates through at least the rest of the year.

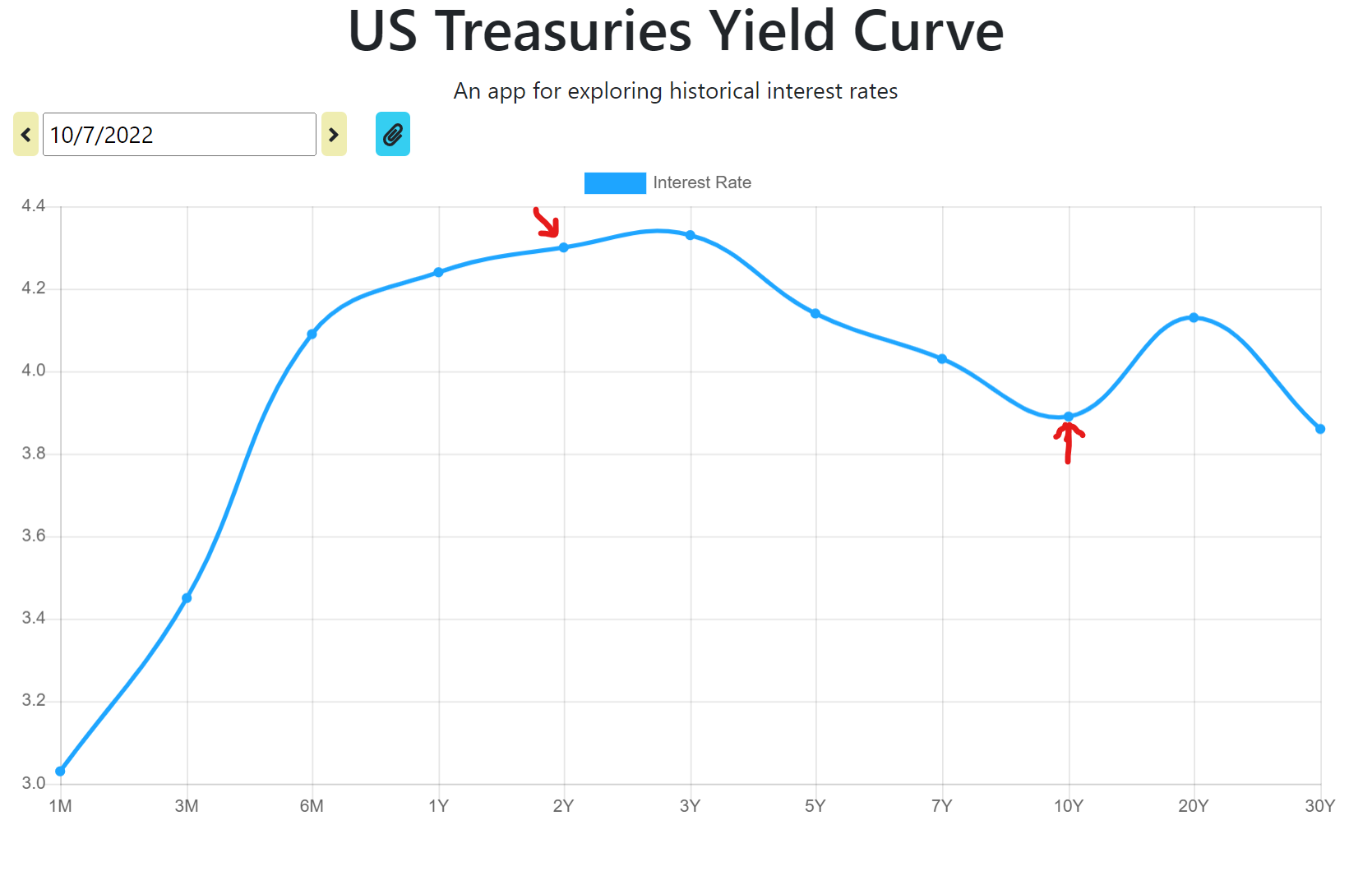

As we get a further into the future the path is less clear. Currently, the yield curve is inverted. This means the interest rate you earn on a 10-year Treasury is lower than the interest rate you receive on a 2-year Treasury, as shown below.

This is unusual because investors typically expect a higher return if they are locking up their money up for a longer period of time in a similar investment. An inverted yield curve is an ominous sign that has historically indicated we are either in a recession or there is one coming. It occurs because investors believe that a recession is coming and they expect that the Fed will need to lower interest rates in the future to stimulate the economy out of the recession.

In conclusion, most investors seem to believe that inflation will eventually get under control and rates will come back down to some degree. When that will happen and by how much rates may be reduced is anyone’s guess. In the meantime, we can expect to see volatility in the value of assets.

One final note: if you are currently negotiating a ground lease, the best way to protect the value of your lease and property is to get as high of an annual rent escalator as possible.

I can be reached at (310) 266-9045 or [email protected].